Okay, so you’ve been putting this off. I get it. As advisors, Paul and I see no shortage of enthusiastic procrastinators. Worse yet, some of them are accomplished. And if you’ve been putting off deciding whether to opt in to the new Department of Defense Blended Retirement System, you might be one of them. If you are, I have good news and bad news. The good news is you still have time–enough time–to review your options and make an active and informed decision to opt in or not. The bad news is you don’t have much. At a minimum you have no time left to waste. So let’s get after this, eh?

Quite possibly the most important thing to understand about this decision is that you have one very good option and one even better option. Which is which is up to you. In broad brush, the difference between BRS and the legacy retirement system is most likely something less than 20%…provided you actually retire from the service. If you don’t retire, regardless of the reason, the difference between the two systems is more like 100%.

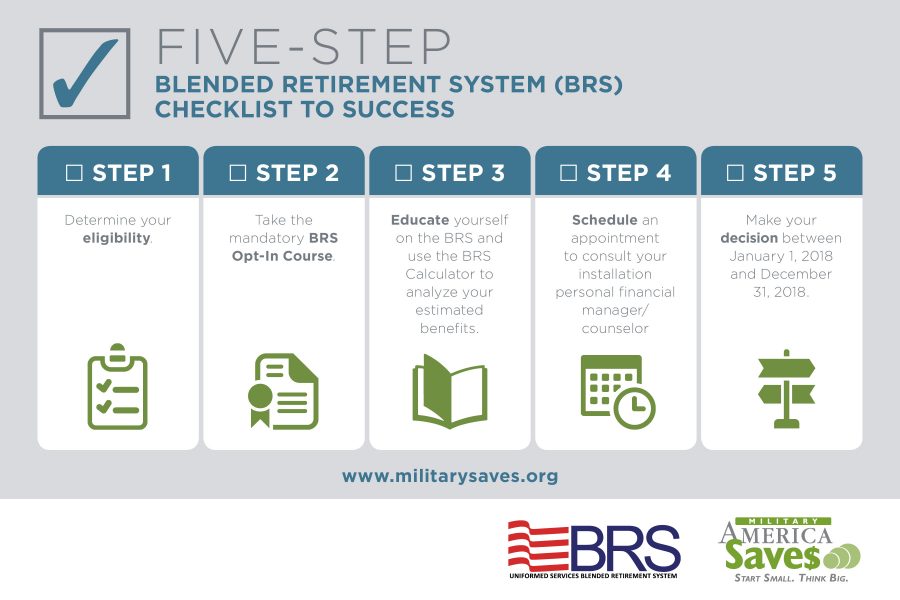

There are a few good reasons why I won’t go into more detail on the relative merits of one system versus the other today. First and foremost, I don’t think there’s any light left to be shed on the topic. For our favorite reads on this decision, check out The Military Guide, Military Dollar or Kate Horrell. All three have already written exhaustively on the subject, and I certainly don’t think I could improve on their work. The second and more important reason I’m not going to get into a detailed comparison today is that I’m not here to inform you. I’m here to get you to act. Because if you don’t actively make a decision between now and the end of the year, DOD will make your decision for you. And it’ll be irreversible. And you may or may not like it. And you’ll still be responsible for it.

I think the first important thing here is to get past the notion of a life without regrets. It sounds really romantic, and it briefs well. But I’ve been on the planet long enough to understand it doesn’t really exist. If you live long enough–and unless you’re a sociopath–you’re going to accumulate some regrets. You may even acquire enough wisdom to consider your regrets blessings, natural byproducts of having enough time here to reflect back on things and wonder about how one thing or another might have gone differently, “if only…” But at the core of that is good problems–good health and a long life. When it comes to the BRS decision, most people I find getting hung up on it are only considering a regret that might attach to a smaller pension at retirement. But retirement from the military isn’t the only scenario in play here. And when it comes to any aspect of financial planning, whether you do it yourself or have a pro helping you with it, proper financial planning starts with a review of all possible scenarios…and then choosing your regrets in advance.

Now, for those of you who want to understand what the numbers look like before making a decision, I’m with ya. I like numbers. A lot. More than numbers, I like context. And numbers are really useful for putting something into better (or even proper) context, especially if you can rapidly play “what if” with different scenarios and see what changes as a result. For the purposes of this decision, basically what we’re talking about is a BRS calculator. You may or may not have seen any of a number of them that have been available online over the last year and change. So have I. Some are better than others, but I’m enough of a numbers nerd to not quite be satisfied by any I’ve seen publicly available. So I built one myself.

The bottom line about any of these calculators is that you have to make a minimum of about fifteen assumptions to get an answer. For most people, that number is likely more like twenty or twenty-five. And some of those assumptions cascade into subsequent assumptions, so if one of them turns out “wrong,” it could make another five or ten or fifteen of them “also wrong.” So putting one of these together is difficult enough before accounting for the possibility that someone will keep punching numbers into it until they get the result they wanted in the first place. Further compounding the difficulty is that another handful of the things we have to assume to model how your decision may play out are things none of us has any control over–investment returns, inflation rate, how big your continuation pay under BRS is, etc. So it’s easy to make irresponsible assumptions to skew a result one way or another. (Think Jim Carrey in this scene in Dumb & Dumber.) But at the end of the day, to conduct a good analysis you have to be able to play with the assumptions to develop your best sense of full context…and then choose your regrets in advance.

So here it is. We developed this with all of the assumptions in play. What that means is you’ll have the ability to lie to yourself if you really want to. But I don’t recommend it. You’re going to have to live with the result whether you actively decide to opt in or not opt in to BRS, or if you let DOD decide for you. So take this on as if you’re actually responsible for it. Read the instructions and assumptions carefully before you start playing with the numbers. And if you just can’t make any sense of it, give us a ring. We’ll be happy to talk you through this. If you can wait a week or so, we’ll be doing a webinar on December 6th to describe it. And if you can’t attend it live, we’ll be recording it, so register anyway and then watch when you can.

So you have a tool now to help you figure this out, and you know where to find us if you need more help. Don’t let yourself get hung up on “perfect.” Just roll your sleeves up and get hot!