At the risk of exposing just how deeply my nerdism runs, I am going to share this little story from my youth because I think it will help me make an important point.

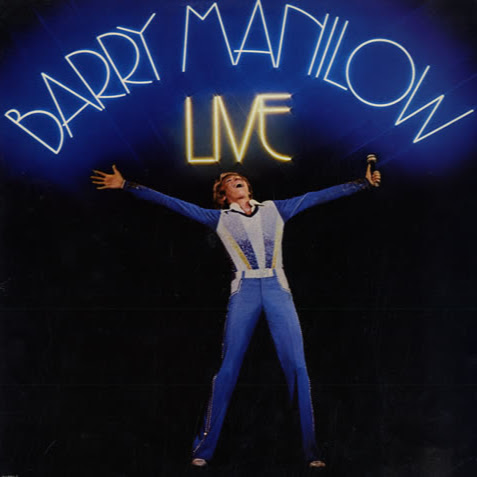

When I was 12 or 13 I made my first music purchase. It was the album Barry Manilow Live, and it was on 8-track tape. I listened to it hundreds of times on a sound system that was fairly advanced for its day.

I think I still have that 8-track tape in a box somewhere. I could never part with something with so much sentimental value to me. It’s a keeper. But one day I will be gone and my children will inherit it – at which point they will very likely discard it. Once a best selling album produced in the highest-available-quality format, it is no longer useful. The father’s music collection is not the children’s music collection.

A similar phenomenon is starting to play out in the world of financial advice.

The Baby Boom generation built the most prosperous nation in world history, but the inexorable march of time is catching up to them. The Social Security Administration estimates 10,000 Baby Boomers die every day, leaving behind accumulated assets that can’t be taken with them; assets that become inheritances. The next twenty-five years will see $30 trillion of wealth transfer from one generation to the next.

What Will the Children do with Their Parents’ Money?

This movement of America’s wealth is starting to become a concern for the brokers and advisers who grew up and grew fat on Dad’s money. For decades they thrived from the growing wealth of the Baby Boom generation. Times were good. Assets were flowing in, and their once-innovative fee structure based on a percentage of assets under management (AUM) made them wealthier every year. There was no urgency to evolve or improve.

They sold their clients fee-laden mutual funds from the fund families that paid big commissions. They constructed portfolios without regard to costs or tax implications. Most advisers to the Boomer generation never bothered with any real financial planning. If they did it was a cookie cutter template. One size fits all. Something free they gave away to convince clients to let them manage their assets.

That same inexorable march of time is catching up with these advisers, too. Generations X and Y don’t want the same financial service Dad got. They grew up with technology. They expect more. Quarterly statements by mail? Seriously? We are 2 decades into the 21st century! I should be able to access that information within seconds from my phone.

We embrace these changes at Redeployment Wealth Strategies. Dad’s financial adviser charged for portfolio management and gave away snapshot financial plans. At RWS we charge you for real financial planning and give away portfolio management. The price of managing your portfolio is built into the financial plan. It no longer makes sense to charge for something that technology makes better, cheaper, and faster than your Dad’s adviser could ever dream of being.

Some advisers are adapting to the new realities, but many are not. They seem to be clinging to the notion the changes in the industry of the past few years are just a fad, not a revolution. They try to keep transferred assets in the firm by appealing to the desire for stability and consistency. “Your father invested with us for 40 years,” they will tell you, “we can take care of you, too.” This is probably a reassuring message to someone who recently experienced significant loss. (Especially if you’re relatively new to the arena of money and investing.) But is it enough?

As a wise man once told me – the only thing that stays the same is that everything changes. The financial planning/advising industry is not exempt from this maxim. A horse was once the most efficient mode of transportation; Fotomat booths once littered strip mall parking lots from coast to coast; Blockbuster used to remind us to “be kind, rewind”. Investment advice used to come with high commissions and fees and no real financial planning.

It’s not like that anymore. Things have changed.

It’s not the Boomers’ fault they paid high fees for portfolio management and never experienced real financial planning. Just like me with my Barry Manilow Live 8-track, the Baby Boom generation did the best they could with the options they had available at the time. But things have evolved since your parents started investing. Just like my children aren’t required to use my music collection, children of Boomers aren’t required to use the investment accounts they inherit. They can take advantage of new technology, personalized service, reduced fees, comprehensive financial planning, and the tax agility they can get with a financial adviser who embraces the revolution that has taken place in financial planning.

Redeployment Wealth Strategies is not your father’s investment adviser. We are the investment adviser he wishes he could have found. Personalized service, transparent fees, and sound investment strategies form the foundation of our financial planning philosophy. You should never expect less.

If that interests you, call us at (757) 752-8055