Some of the most sensitive financial planning topics for military people are the financial decisions you make at the time of retirement. Even if you don’t serve long enough to retire, many of the strategies mentioned below may be useful when you transition out of the military. If you want to learn more about this stuff, you can join us for a webinar that’ll go deeper into all these things. The webinar is free to attend and obligates you to nothing. It’ll also be recorded, so if you register (and only if you register) but can’t make it you’ll be able to watch it at your convenience.

Survivor Benefit Plan. The Survivor Benefit Plan (SBP) is probably the retirement decision that ties us in knots more than all the others put together. As a planner, the shortest way I describe this is that it’s a one-size-fits-all program but not a one-size-fits-all decision. It may be the most complex military retirement decision you make, and to ratchet up the complexity even more, if you’re married your spouse must be involved in the decision. So don’t beat yourself up if it’s tying you in knots. Just don’t let it paralyze you. To start untangling those knots, I think it’s important to first frame the decision properly by understanding what SBP is and what it is not.

For the vast majority of us, full coverage costs 6.5% of our monthly retired pay and in the event of the veteran’s death delivers 55% of monthly retired pay to the beneficiary (typically the surviving spouse) every month for as long as he/she draws breath. If you think that sounds like life insurance, you and I are in violent agreement. From a planning perspective, if (1) I’m paying for a future benefit that (2) only someone else can collect and (3) only if I’m dead first, then we’re talking about life insurance. And in a world in which life insurance policies are largely commodities, SBP is legitimately unique, so I don’t recommend ruling it out without a thorough analysis.

I strongly urge you to look at your SBP decision like you would any other life insurance question. You want to determine if SBP is the best option for your life insurance needs. I think of ‘Best’ as being at the intersection of want, need, and affordable.

In terms of determining need, you can do a pretty quick analysis on your own with the LifeHappens.org need analysis calculator. It’s not perfect, but you can step through it with a minimum of guidance and rapidly evaluate the impact of changing one or more planning assumptions–how much income to replace, whether or not to pay off the mortgage, private/public/no college funding for the kids–to determine your coverage need, as well as starting to get your head wrapped what you want and can afford. And you can factor SBP coverage into (or out of) that calculator as if it were earned income for your surviving spouse.

The part most people don’t do well: You should determine your life insurance needs at least twelve months prior to your retirement date. Why? In your last year of service you start doing all your retirement and VA disability rating physicals. For those physicals you want be evaluated for everything that might possibly be wrong with you. But to qualify for affordable insurance premiums you want to look as healthy as possible. So, get that insurance physical done BEFORE you request the Department of Veterans Affairs evaluate you for sleep apnea. Because if you don’t, the good people at Prudential, Navy Mutual Aid and every other private insurer are going to charge you premiums like you’re a pack-a-day smoker. That could narrow your coverage options at a time you want to have the widest possible range of options.

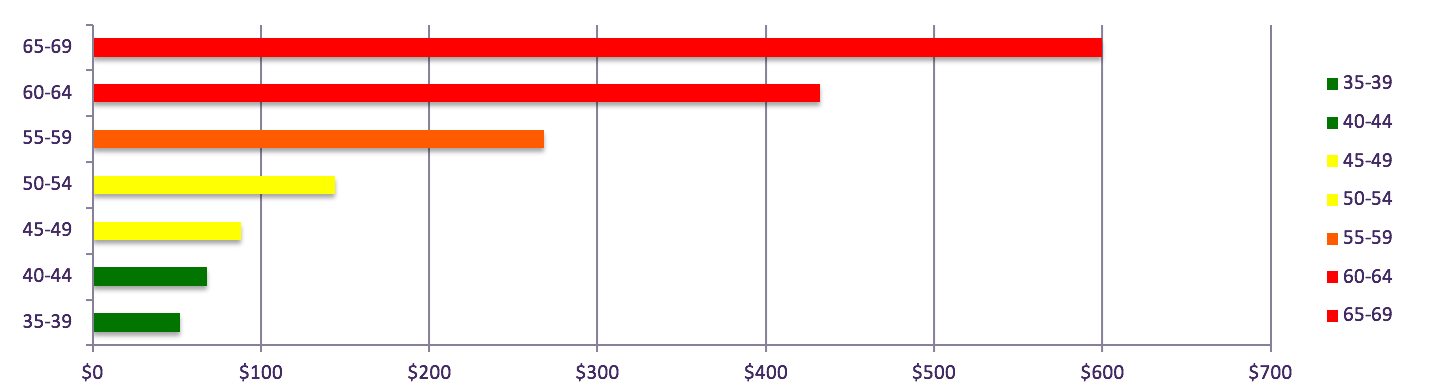

SGLI Conversion. This one’s a little more straightforward. What’s VGLI? Veterans’ Group Life Insurance. It’s the group life option that replaces SGLI when you separate from the service. Note the word “separate,” not “retire.” The option to convert your SGLI coverage to VGLI coverage is available to all veterans, not just retirees. Just like your SGLI coverage (and your SBP), VGLI requires no underwriting as long as you convert the coverage when you separate. You’re actually automatically covered for 120 days after your separation/retirement date, but you must opt in if you want to keep the coverage longer. What’s different about VGLI is that you begin to pay for your age. To maintain the maximum $400K coverage, here’s what the costs look like as you age:

As you can see, those premiums are substantially higher than your SGLI is/was. And here is where we most easily see “no denial of coverage” is a two-edged blade. If you’re a 59-year-old your VGLI premium for $400K of coverage will be $268/month – whether you’re a two-pack-a-day-smoker or a cross-fit marathon runner.

The tip here is the very same as what we just discussed for SBP. Assess your coverage needs/wants/budget 12 months before separating to give yourself time to investigate all options for how to meet that need.

Thrift Savings Plan. Okay, for you retirees, here’s some straightforward truth. When people in my industry find out you’re getting ready to retire, they’re going to dog pile you with all kinds of reasons why you should roll over your TSP balance into an IRA they “manage.” Here’s the bottom line, though – most industry pros are much better served by your TSP rollover than you are. You will nearly always be best served leaving your TSP right where it is–where your costs are literally almost ZERO–and allocating it according to your investment & life plan. At a bare minimum, don’t be in a hurry to roll it over. You can’t contribute to TSP any longer after you retire, but you can still maintain and manage the account. But once you’ve rolled it all out you can’t roll it back in.

As an entering argument, the TSP tip here is “just don’t”. There’s probably not a good reason to do it immediately after you retire. If someone’s talking your ear off about why you should stop procrastinating and just do it already, give us a shout. We love playing Point/Counterpoint, so we’ll have that conversation just for kicks. Same recommendation for those of you who are separating.

Long Term Care. This one’s for retirees only, and mostly to keep in your back pocket. As federal annuitants, both you and your spouse are eligible for coverage under the Federal Long Term Care Insurance Program (FLTCIP). As with TSP, you don’t have to make decisions about this right away. And with long term care, a decent rule of thumb for “best” time to figure this out is in your early to mid fifties, when you may begin to see some tax benefits of coverage, but before premiums rise too rapidly. When you do start looking at long term care insurance, proceed with caution. Some of the stats you’ll hear or read are pretty scary, and they’ll be 100% true…but they’re being pitched by the people who sell long term care insurance, and they’re most likely not 100% of the truth. Bottom line regarding long term care isn’t necessarily that you need coverage. I firmly believe you need a plan…but you probably don’t have to figure it out while you’re retiring from active duty military service. The coverage is available any time after you retire. Give the FLTCIP coverage calculator a look for longer-term awareness, but don’t panic into coverage right away.

Summary. To briefly recap the three tips:

- Assess your life insurance needs, wants and budget 12 months prior to retiring/separating. Investigate all of your coverage options–SBP, VGLI and private coverage–for fulfilling them before doing any of your separation physicals.

- DO NOT be in any kind of hurry to roll over your TSP into an IRA. The benefits promised to you are almost certainly not time critical. But the costs will be substantial and permanent.

- Take a peek at long term care, but like TSP this also does not require immediate action.

Believe it or not, we’ve only begun scratching the surface on these topics here–particularly the SBP decision. But again, we’ll go deeper into all of these topics in our webinar on October 17th. If you want to learn more, we’ll look forward to seeing you there!