Does it Really Matter How Your Financial Adviser Gets Paid?

YES!

This blog post got long and technical, so I decided to turn it into a narrated slide show to make it more digestible. Or you can read the article below. Or you can do both. Either way I hope you find what you are looking for!

Just a few decades ago there was not much choice in the way you paid your financial adviser. Either they sold you a financial product and were paid a sales commission from the product manufacturer, or they gathered your assets and charged you an “Assets Under Management” fee. (Sometimes they did both.) Neither of those structures works very well for the majority of military families. Few military families need the commission-based products, and even fewer are able to afford the AUM pricing model.

Well, Bob Dylan was right. The times, they are a-changin'. There is now a variety of ways financial advisers are charging their clients. On balance this is a good change for consumers, especially military families. It brings transparency and price competition to the financial advising marketplace.* Unfortunately, it also brings the 'tyranny of choice', where too many options can lead to 'paralysis by analysis'. You can’t decide which option to choose, so you become paralyzed don’t do anything.

This article compares the various fee models now in use. It should help the reader form a basis for determining the total cost of the advice they are receiving. Fair warning, though – Sean and I are not disinterested bystanders in this discussion. We are active participants. We are running a business and we have individual financial goals just like everyone else. We could make a successful business with any of the fee models discussed. We did not choose the fee structure we use at RWS because we thought it was the best way to make money. We chose it because we believe deeply that it helps make us better advisers to the tribe we want to serve - military and veteran families. If I state that one aspect of a fee model is better or more important than another, it is often in the context of being better for our target audience of military and veteran families.

The Fee Models

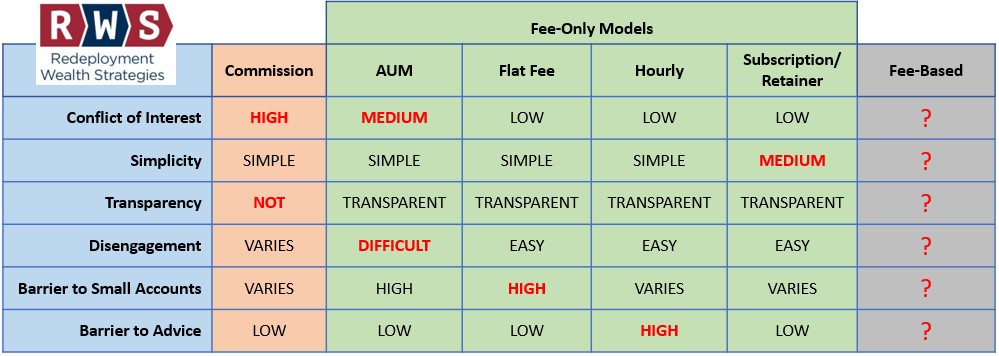

I am comparing the following Fee Models:

- Commission

- Four (4) types of Fee-Only Models

- Assets Under Management

- Flat Fee

- Hourly

- Retainer / Subscription

- Fee-Based

The Basis for Comparison:

Conflicts of Interest. Whether the fee model introduces conflicts of interest between the adviser and the client.

Simplicity. The ease of understanding how the fee was derived as well as the simplicity (to the client) of making the payment.

Transparency. A measure of how obvious the amount of the adviser’s fee is to the client.

Disengagement. Whether the fee model complicates the client’s ability to fire the adviser.

Barriers to Small Accounts. Whether the fee model makes it more difficult for new investors or investors without significant investable assets to obtain advice.

Barriers to Advice. Whether the fee model creates an impediment to obtaining regular access to advice.

Commission

In this model the client purchases a financial product (I.e. a life insurance policy) and the person selling the product is compensated by receiving a commission on the sale. This arrangement, while quite common, creates the most conflict of interest of any of the fee models. The ‘adviser’ has an economic incentive to sell the products with the largest commissions. This may influence the adviser’s judgment. The commission model also tends to be the least transparent. While most of us are vaguely aware the guy who just sold us the insurance policy isn’t working for free, we usually have no idea how much he earns by selling us a particular product.

The best parts about the commission model are that it is simple and provides no real barrier to advice. The commission model may present some barriers to small accounts and to disengagement, but these are generally specific to the product. You will need to analyze the specific product if you have concerns about these issues.

Assets Under Management (AUM)

In this construct the adviser is paid based on a percentage of the client portfolio the adviser directly manages. Usually 1 – 2%. This is the oldest of the fee-only models, but it is starting to show some signs of age. Of all the fee-only models it presents the most conflicts of interest because the adviser is provided an economic incentive to gather assets under their management – and never let them go. If you have money in your TSP account, the adviser can’t collect a fee for managing it. She has an economic incentive to advise you to roll your money out of TSP and into an account she can manage (and collect a fee on). Likewise, if you ask if you should apply extra money to your mortgage – or take money out of an investment account to pay off your mortgage – the advisor compensated by AUM has an economic incentive to tell you to put/keep that money into the investment account.

Another drawback of this model is that is presents significant barriers to small accounts. At an industry average 1.25% AUM fee, the adviser earns just $125 on a $10,000 client account. This has led to the widespread use of account minimums by advisers. They can’t take you on as a client until you have already accumulated a sufficiently large account to make it worth their while. This is usually $100,000 or more. If you’re just getting started – a time when most people would receive the most benefit from sound financial advice – their compensation model prevents them from advising you.

It is also difficult to disengage from an adviser who charges for AUM. In order to stop paying them you must move your assets out from under their management. Meaning you must find another adviser first or you must be prepared to set up and manage your accounts on your own.

The benefits of the AUM model is that it is fairly simple to explain, it is reasonably transparent, and once implemented it presents no barriers to receiving advice.

Flat Fee

This is the one size fits all model. There is a fixed annual fee, and it is the same for each client. Sean and I could fall in love with this model. We like nearly everything about it. It is simple, transparent, presents low conflicts of interest, it is easy to disengage from the adviser, and it presents no barriers to advice. Unfortunately, we can’t get past its one weakness. It presents a significant barrier to small accounts. To have a sustainable business model, the one-size-fits-all fee we would have to charge each client would be unaffordable for a demographic we want to serve – namely NCOs and junior officers who are just starting their financial journeys. As I will point out in more detail later, we resolve this by setting the fee based on the complexity of the client’s financial situation.

Hourly

An hourly fee is another structure we have tried to love. It provides low conflicts of interest, is simple and transparent, makes disengagement easy and has generally low barriers to small accounts, (Although you can imagine an hourly rate that presents a high barrier to small accounts!) Its primary drawback is that is presents a barrier to advice. We want our clients to ask us questions. Lots of questions. It is typically much easier to answer a question up front than to fix a problem caused by an unasked question later. Clients paying by the hour have an incentive to keep the hours low. So, they don’t ask questions. It is difficult to build a trusting relationship between client and adviser when both parties know ‘the clock is running’. Despite this, RWS will use an hourly rate for limited project work. If the client has a simple issue on which we can advise without developing a comprehensive financial plan, we may quote them a project price based on an estimated number of work hours.

Subscription / Retainer

I use the words subscription and retainer interchangeably to describe the compensation model in which the client pays a fee in monthly (or quarterly) increments. This is the fee structure we use at RWS. It provides low conflicts of interest, transparency, makes it easy to disengage, provides no barriers to advice, and (as applied at RWS) low barriers to small accounts. (Other firms implementing this model may have higher barriers to small accounts.)

At RWS we develop an annual fee based on the complexity of the client’s financial situation and allow the client to pay their annual fee in monthly or quarterly increments (or all at once if they prefer). As described here, we use modified net worth as a proxy for complexity. We also apply a series of mitigating factors to lower the fee to get a more accurate representation of financial complexity. The result is a fee structure that scores well in all the areas we care about except simplicity. It takes longer than the other models to explain. All things considered, we are satisfied it is the best model to serve military clients.

Fee-Based

The rise in popularity of the Fee-Only model has not gone unnoticed. Some advisers have implemented a combination of sales commissions and fees-for-service. They call it “fee-based” because it sounds like fee-only. Do not confuse it with fee-only. The combinations of commission and fees are too many and varied to attempt an analysis here. Some are not too bad and some are awful. If you are considering a fee-based adviser do your due diligence and ask a lot of hard questions.

Side-by-Side-Comparison of Financial Advisory Fee Structures

Conclusion

RWS uses a fee-only subscription model that we believe offers the best combination of low conflicts of interest, transparency, fairness, and accessibility to military and veteran families. It fosters a high level of trust and engagement between the adviser and the client. If you would like a free consultation to see if you would like to work with us, please call (757) 752-8055.

*If you’re not convinced price competition is a good thing, consider the following. On April 30, 1975 the cost to retail investors of a stock trade was fixed by the Securities Exchange Commission at $200 (those were 1975 dollars, btw). De-regulation occurred on May 1, 1975 and retail investors can now get stock trades for $4.95 or cheaper in 2019 dollars. In real terms price competition has caused the price to fall by more than 99%!